Contribution Margin Is the Amount Remaining After

Cost of goods sold has been deducted from sales revenues. Variable expenses have been deducted from sales revenue.

Angle Of Incidence In Accounting Accounting Cost Accounting Business Risk

Contribution margin calculates the.

. Fixed expenses have been deducted from sales revenue. It can be expressed as a total amount as a per unit amount or as a ratio. Contribution per unit 100 - 60 40.

Cost of goods sold. The amount of revenue required to earn a target profit is equal to Total fixed cost divided by contribution margin Total fixed cost divided by the contribution margin ratio Targeted profit divided by the contribution margin ratio Total fixed cost- plus targeted profit divided by contribution margin ratio Targeted profit divided by the variable cost ratio. 200000 Contribution per unit View the full answer Transcribed image text.

Variable expenses have been deducted from sales revenue b. Fixed expenses have been deducted from sales revenue. That is it refers to the additional money that your business generates after deducting the variable costs of manufacturing your products.

Fixed expenses have been deducted from sales revenue. Fixed prices related vary variable prices and contribution margin. In accounting contribution margin is defined as revenues minus.

Contribution Margin Net Sales Revenue Variable Costs. Cost of goods sold has been deducted from sales revenues 2 The contribution margin ratio is equal to a. Contribution should be calculated using the accrual basis of accounting so that all costs related to revenues are recognized in the same period as the revenues.

Formula for Contribution Margin. Contribution margin 40 2000 units 80000. Fixed expenses have been deducted from variable expenses.

1 Contribution margin is the amount remaining after. Contribution margin is the amount remaining after. Fixed expenses have been deducted from sales revenue.

Variable expenses have been deducted from sales revenue. Answer 17 cVariable expense as Contribution margin Sale - Variable expense Answer 18 c. Managerial Accounting BUS 5110 Contribution margin is the amount of earnings remaining after all variable costs have been.

Contribution margin is the revenue remaining after subtracting the variable costs that go into producing a product. Contribution margin is the amount remaining after. The contribution margin is the income remaining after the variable costs have been covered and it is used to contribute to the fixed costs.

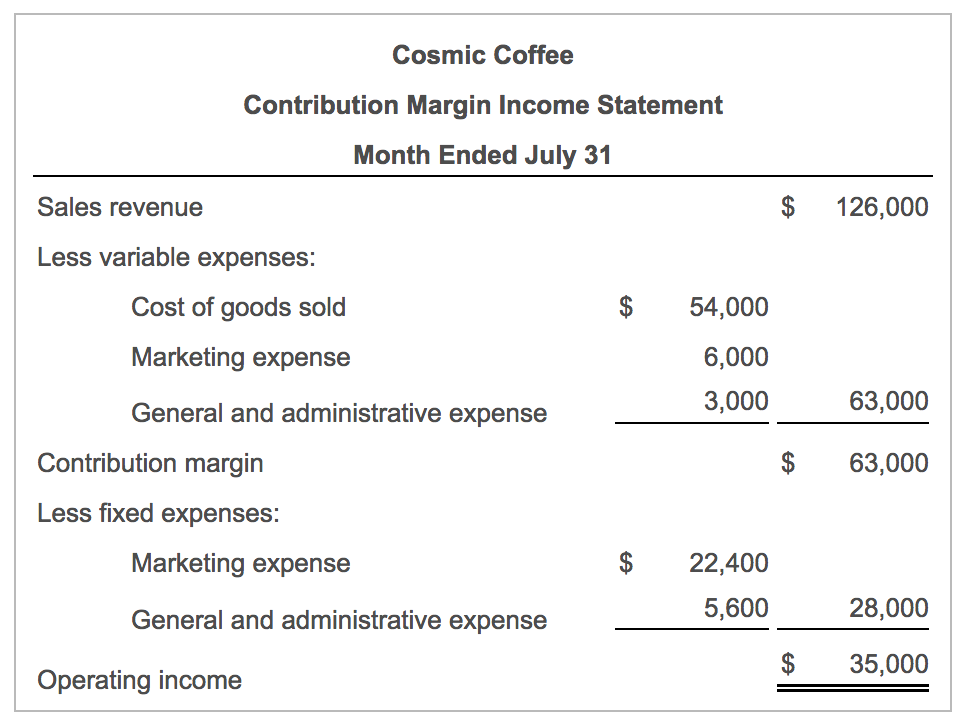

Contribution margin is the amount remaining after variable expenses have been deducted from sales revenue. You can think of it as the amount of money each unit brings in to pay the fixed cost. If the fixed costs have also been paid the.

Contribution margin is the amount remaining after. 1 Contribution margin is the amount remaining after. Cost of goods sold has been deducted from sales revenues.

Contribution margin is the amount of revenue remaining after deducting. Contribution is the amount of earnings remaining after all direct costs have been subtracted from revenue. Contribution margin is the amount of revenue remaining after deducting 17.

The break-even in units sold will decrease if there is an increase in. Cost of goods sold. Net income is a.

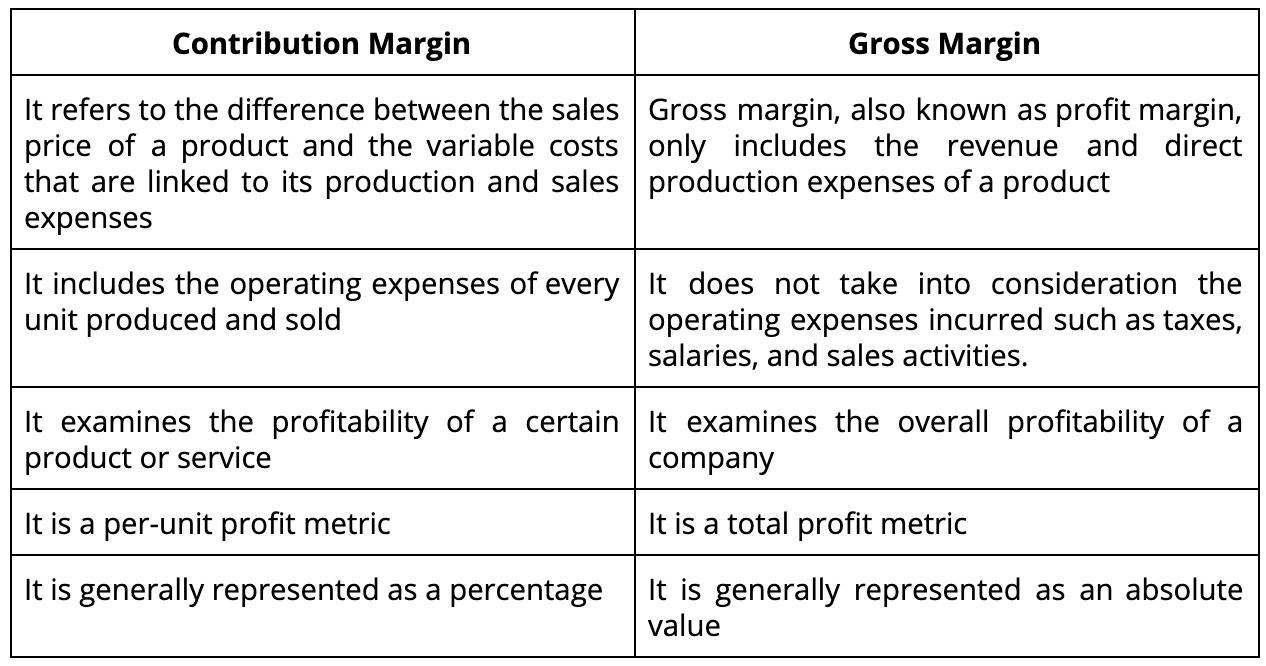

Fixed expenses have been deducted from variable expenses. Fixed expenses have been deducted from variable expenses. Contribution margin is a cost-accounting calculation that tells a company the profitability of an individual product or the revenue that is left after covering fixed costs.

Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales. Variable expenses have been deducted from sales revenue b. Contribution margin is the amount of revenue remaining after deducting a.

Before analyzing contribution margins lets evaluation some key ideas. Fixed expenses have been deducted from variable expenses d. Fixed expenses have been deducted from sales revenue c.

This remainder is the amount available to pay for any fixed costs that a business incurs during a reporting period. Fixed expenses have been deducted from sales revenue. Variable expenses have been deducted from sales revenue.

Cost of goods sold has been deducted from sales revenue. It is identified in a CVP income statement which classifies costs as variable or fixed. Contribution is the amount of earnings remaining after all direct costs have been subtracted from revenue.

Moonwalkers CVP income statement included sales of 4000 units a selling price of 100 variable expenses of 60 per unit and fixed expenses of 88000. Up to 256 cash back Contribution margin is the amount remaining after. Variable expenses have been deducted from sales revenue.

Variable expenses Averkamp 2018. Cost of goods sold has been deducted from sales revenues. The contribution margin can be expressed as an as a.

Buerhrles CVP income statement included sales of 2000 units a selling price of 100 variable expenses of 60 per unit and fixed expenses of 44000. In terms of computing the amount. Contribution Margin refers to the amount of money remaining to cover the fixed cost of your business.

Contribution margin is the amount of revenue remaining after deducting variable costs. Fixed expenses have been deducted from variable expenses.

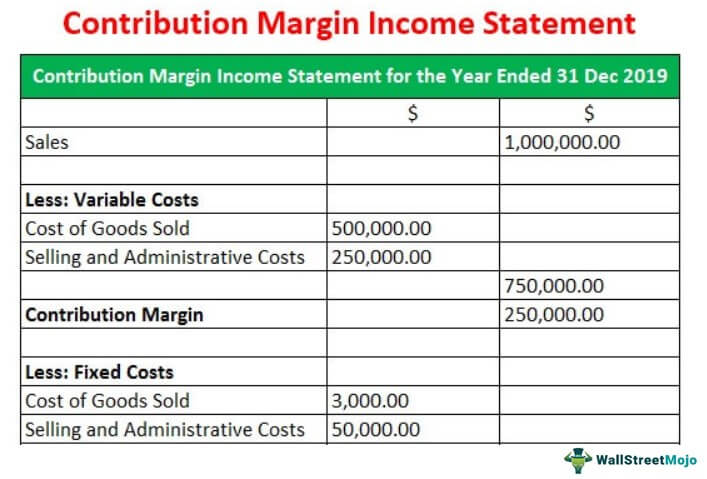

Contribution Margin Income Statement Explanation Examples Format

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin After Marketing Cmam Overview Formula Uses

Profit Margin How To Calculate Man Hour Types Of Taxes Cost

Pin By Eswap On Inventory Management Formulas In 2021 Method Pie Chart Inventory Management

Input And Consumption Materials Construction Estimator Construction Estimator Electric Arc Welding Welding Gas

Raising The Minimum Wage Has Caused Small Business To Fail In Seattle Minimum Wage Wage Helping Others

Contribution Margin Contribution Margin Financial Analysis Learn Accounting

Contribution Margin Definition Formula Video Lesson Transcript Study Com

Action Over Thinking School Rating Strategy Map Investing

How To Estimate Estimate Bid Man Hour

How To Make A Reliable Bid Man Hour Bid Financial

Pin By Billy The Goat On 100 Verified In 2022 Behavior Analysis Study Course Fixed Cost

Marketing Report Template Word Inspirational Daily Market Visit Report Format Weekly Marketing Templ Marketing Report Marketing Report Template Report Template

How To Calculate Profit Margin Calculator Profit Customer Inquiry

Margin Of Safety Financial Statement Analysis Investing Rules Cash Flow Statement

Comments

Post a Comment